TOPIC

The Role of an Accountant in Planning for a Stress-Free Retirement

Understanding Retirement Needs

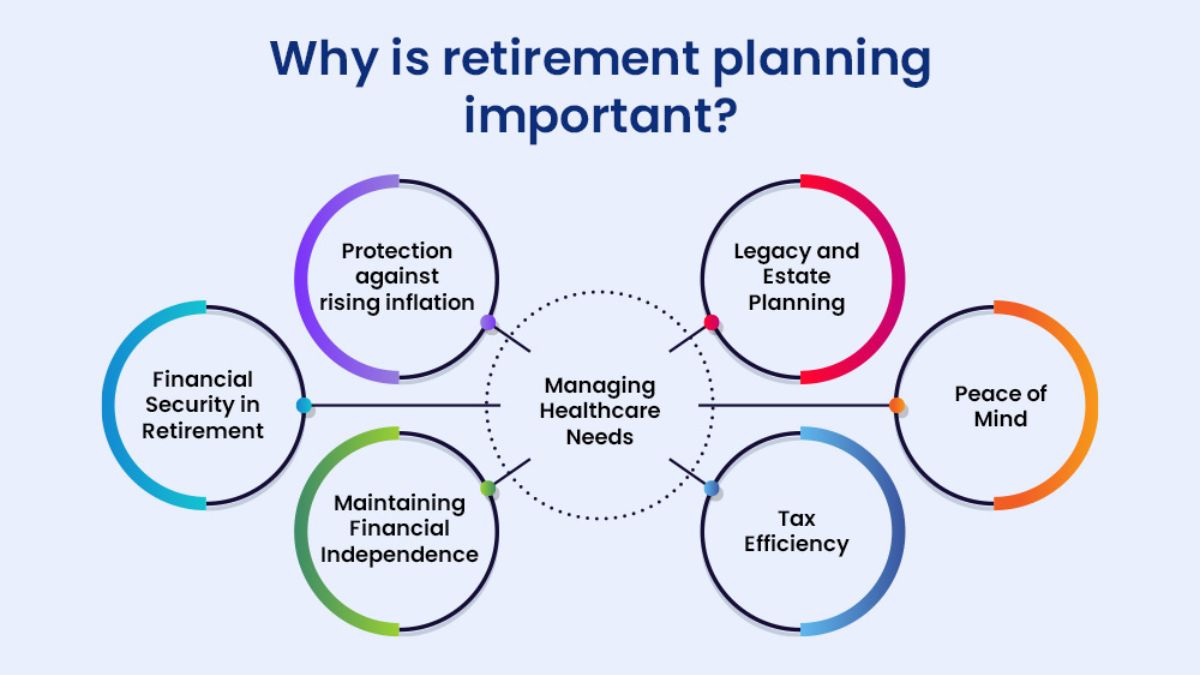

Planning for retirement is a journey toward ensuring financial security in your golden years. It involves identifying and aligning your future needs with your current financial strategies. This is where an accountant plays a pivotal role, especially considering the intricacies of retirement planning Somerville, NJ. Each individual’s retirement picture is unique, influenced by lifestyle choices, healthcare requirements, and desired retirement age. It is essential to anticipate changes in the variables of life and adjust plans accordingly. Given the diverse spectrum of retirement scenarios, a custom-tailored plan will likely serve better over generic solutions.

Understanding these nuances helps create a roadmap for a comfortable retirement. Many fail to consider inflation effects, potential medical needs, and the lifestyle they aspire to maintain. An accountant’s insight can bridge these gaps and align objectives with practical plans. They can foretell additional unforeseen circumstances, such as the need to support dependents or alter travel itineraries due to health constraints, ensuring a smoother transition into retirement life.

Building a Strong Financial Foundation

A solid financial foundation is crucial before diving into the complexities of retirement investments. This involves managing your debts prudently, establishing a robust savings plan, and maintaining a budget that accommodates your future aspirations. Accountants offer invaluable guidance in tracking expenses, setting realistic savings goals, and ensuring that debt is minimized before retirement. For instance, consolidating high-interest debts into lower-rate loans can free more income for savings.

Moreover, consistent budgeting helps you monitor and adjust spending habits to support long-term financial health. Tracking progress, making incremental adjustments, and celebrating small milestones are part of this process. This foundational element fortifies the groundwork for the more intricate aspects of retirement planning, like investment strategies and maximizing returns.

Tax Optimization Strategies

Undoubtedly, taxes are an inevitable part of life and don’t disappear in retirement. However, a strategic approach can mitigate their impact. Accountants can help devise tax-saving strategies that ensure your retirement funds are maximally exploited. This includes understanding the deductions, exemptions, and credits that retirees can leverage. Taking advantage of tax-advantaged retirement accounts, like IRAs and 401(k)s, can defer taxes and compound savings over time.

Proper tax planning increases income retention and protects savings from being eroded by unexpected tax obligations. Accountants can also provide insights into minimizing tax liabilities through charitable contributions and other tax-efficient options, ensuring financial resources extend throughout retirement.

Investment Portfolios and Risk Management

Building a diversified investment portfolio that supports your retirement objectives is crucial. Assessing risk tolerance and comprehending the various investment possibilities are the first steps in this process. Accountants are adept at managing risk and building portfolios that optimize returns. They consider financial circumstances, market movements, and degree of comfort with market volatility. A key tactic is diversification, which helps shield against market volatility by distributing investment risk over several asset classes, including stocks, bonds, and real estate.

- Understanding different types of investments

- Assessing risk tolerance

- Creating a diversified portfolio

Investments need ongoing management and rebalancing to align with changing goals and market conditions. This proactive approach helps adapt to and sustain financial growth despite economic uncertainties.

Navigating Social Security Benefits

Understanding how to maximize Social Security benefits is critical. While seemingly straightforward, the details and timing of these benefits affect the total amount you receive. Accountants help to strategize the optimal time to start receiving benefits based on other income sources and financial needs.

Informed decisions on Social Security can dramatically affect the sustainability of retirement savings over the long term. This involves calculating the break-even point for early versus delayed claims and integrating benefits into an overall retirement income strategy, safeguarding against common pitfalls like reduced spousal benefits or misconceptions about eligibility.

Estate Planning Essentials

Estate planning is crucial to retirement planning since it ensures that your assets are protected and distributed according to your intentions. Getting expert advice while creating trusts, preparing wills, and comprehending estate taxes is beneficial. An accountant can ensure that these records reflect your financial plans and long-term objectives. They can also assist in figuring out how much liquidity is required to pay for estate costs without jeopardizing your long-term financial security. Knowing that your wishes will manage your legacy is a comfort that comes with effective estate planning. It reduces the probate process and possible heir conflicts by ensuring recipients receive their intended inheritance and protecting against legal challenges.

Adapting to Life Changes

Life is a journey that is constantly changing and full of unexpected turns. Retirement planning needs must be adaptable enough to consider life events like changing healthcare requirements, unanticipated costs, or lifestyle changes. The capacity of an accountant to modify your financial plans in light of these developments can ease your stress and guarantee the security of your retirement. A flexible plan encourages financial stability and longevity. Reviewing your retirement plan regularly can help you find areas for improvement and provide you the flexibility you need to adjust as life changes.

Working with Professionals

Engaging with financial advisors, accountants, and legal experts ensures comprehensive retirement planning. These professionals bring a wealth of knowledge and insight into managing complex financial situations. They collaborate to provide a balanced approach that covers all the critical areas, from investment and tax strategies to estate planning and beyond.

In summary, an accountant’s role in retirement planning extends beyond number crunching. Their expertise is crucial in shaping a plan that meets financial goals and provides peace of mind for the retired life ahead. By leveraging professional networks and knowledge, individuals can tailor robust and resilient retirement strategies, securing financial well-being for future years.

TOPIC

How Wildlife‑Related Crashes Affect Liability And Insurance Claims

Every year, wildlife causes thousands of accidents on our roads. These crashes can be distressing and lead to unexpected consequences. When you collide with an animal, you’re not just facing potential damage to your car. You might also deal with serious injuries and complex insurance claims. Understanding your liability in these situations is crucial. Insurance policies often vary, and knowing what to expect can help you navigate this tricky situation. You may wonder about coverage for repairs and medical costs. Or perhaps you’re concerned about how this affects your insurance rates. Each situation is different, and the details matter. Learn about your rights and responsibilities to protect yourself better. It’s essential to stay informed. As you drive, stay alert and watch the road. Discover more about how wildlife-related crashes impact your insurance claims and liabilities. Your awareness could make a significant difference in your life.

Understanding Wildlife-Related Crashes

Encountering wildlife on the road can be sudden and frightening. Animals like deer, moose, and even smaller animals pose significant risks. The damage can be extensive, affecting both your vehicle and your peace of mind. These incidents often happen during dawn and dusk when animals are most active. Avoiding such crashes requires vigilance and quick reactions. However, accidents still occur despite your best efforts.

Liability in Wildlife-Related Accidents

Determining liability in wildlife accidents is often complex. Generally, no one owns wild animals, so the responsibility doesn’t fall on a specific party. If you collide with wildlife, liability typically rests with the driver. This means you could be responsible for repair costs and potential increases in insurance premiums. Knowing what your insurance covers is essential. Comprehensive coverage often includes animal collisions, while liability insurance does not. Reviewing your policy details can prevent surprises later.

Insurance Claims: What to Expect

Filing an insurance claim after a wildlife crash can seem daunting. Knowing the steps to take can ease the process. First, ensure everyone’s safety and contact authorities if necessary. Document the incident with photos and notes about the conditions and time. Contact your insurance company promptly to report the accident. Each insurer may handle claims differently, so understanding your policy helps. Coverage for repairs, medical costs, and even towing depends on your insurance type.

Comparing Coverage Types

| Coverage Type | Includes Wildlife Collisions | Repair Costs Covered |

| Liability Insurance | No | No |

| Comprehensive Insurance | Yes | Yes |

| Collision Insurance | Sometimes | Depends on the provider |

This table shows how different coverage types handle wildlife collisions. Comprehensive insurance is your safest bet for full coverage in these scenarios. Always review your policy documents to understand your coverage scope.

Prevention and Safety Tips

Preventing wildlife crashes involves both awareness and action. Stay attentive, especially in areas with high animal activity. Use high beams when safe to spot animals earlier. Slowing down can give you more time to react. In areas with frequent wildlife crossings, be extra cautious. Whistles or devices claiming to deter animals are often ineffective. Instead, focus on driving carefully and maintaining control at all times. For more safety tips, visit National Highway Traffic Safety Administration.

The Role of the Community

Communities can play a part in reducing wildlife-related accidents. Local measures like installing signs or creating wildlife corridors can help. Educating drivers about high-risk areas and times is effective. Collaborating with local wildlife experts to understand animal patterns can also reduce incidents. Community effort is key to safer roads for everyone.

Conclusion

Wildlife-related crashes are unpredictable but manageable. By understanding your insurance policy and knowing your responsibilities, you can better handle these incidents. Prevention is key, but when accidents happen, being prepared helps. Ensure your policy covers potential wildlife encounters. Stay informed and cautious on the road. By taking these steps, you protect yourself and others. Drive safely and stay aware to minimize risks and enjoy peace of mind.

TOPIC

What To Do If A Drunk Driver Causes A Fatal Accident

A fatal accident involving a drunk driver shatters lives. If you face this tragedy, knowing your next steps is crucial. This guide helps you navigate these challenging moments. First, ensure your safety and others around you. Contact emergency services immediately. Authorities need to secure the scene and gather evidence. Then, reach out to family or friends for emotional support. The impact of such an event can be overwhelming. Seek professional legal advice promptly. Legal experts can help you understand your rights and options. Their assistance may be vital in ensuring justice for your loved one. Document everything you remember about the incident. Details can be essential later. Also, consider seeking counseling. Emotional recovery is as important as legal resolution. Addressing these steps eases the burden during this difficult time. Being prepared supports you in handling this tragic situation with strength and clarity. You are not alone in this journey.

Immediate Steps After the Accident

Once the scene is secure, focus on gathering information. Collect the names and contact numbers of witnesses. Take photos of the accident site if possible. These will aid in building your case. Understandably, emotions run high. However, clear documentation is crucial. Law enforcement will compile a report. Request a copy for your records. This report contains essential details. It will be crucial for legal and insurance purposes.

Legal Considerations

Engaging with the legal system can be daunting. Yet, it is an important step forward. Secure a reputable attorney experienced in dealing with drunk driving incidents. They will navigate the complexities of the law on your behalf. Start this process early. Legal procedures often require extensive time and effort. The attorney will help file claims and represent you in court if necessary.

Emotional and Psychological Support

Processing grief and trauma requires time and support. Many find comfort in speaking with counselors or support groups. There are professionals trained to help you through this difficult period. Friends and family members are also invaluable. Be open about your needs and feelings. They can offer a listening ear and necessary support.

| Support Option | Advantages | Disadvantages |

| Professional Counseling | Expert guidance, Confidential | Costly, Requires scheduling |

| Support Groups | Shared experiences, Community support | Availability varies, Less personalized |

| Family and Friends | Immediate availability, Emotional bond | May lack expertise, Emotionally invested |

Financial and Insurance Matters

Accidents lead to unexpected financial burdens. Insurance claims need to be filed promptly. Contact your insurance company to start the process. Provide them with the accident report and any additional information. It is also wise to consult with your legal advisor during this stage. They can ensure all documents are appropriately handled. In some cases, the process may lead to compensation. This can aid with medical or funeral expenses.

Long-Term Recovery and Resolution

Healing from this tragedy takes time. Some days will be harder than others. Establishing a routine can help restore a sense of normalcy. Engage in activities that bring you relief and comfort. Consider joining initiatives that advocate against drunk driving. Contributing to a cause may offer a sense of purpose.

Additional Resources

For more guidance, visit the National Highway Traffic Safety Administration (NHTSA). They offer resources on dealing with drunk driving incidents. You can also explore the Mothers Against Drunk Driving (MADD) website for support networks and advocacy opportunities.

Dealing with the aftermath of a drunk driving accident is a profound challenge. Each step taken brings you closer to resolution and healing. Reliable support and information make a significant difference. Remember, while the journey is difficult, you have resources and people ready to help. By taking active steps, you honor the memory of your loved one and contribute to a safer community.

TOPIC

How To Prove Liability In A Las Vegas Personal Injury Lawsuit

When you’re injured in Las Vegas, proving who is responsible matters. Understanding how to prove liability is crucial. This guide breaks down what you need to know for a personal injury lawsuit. You might feel overwhelmed, but remember, you are not alone. Liability determines who pays for damages and injuries. You need evidence to show fault clearly. FriedmanInjuryLaw offers support in gathering this evidence. First, you need to collect reports and witness accounts. Second, document medical records and expenses. Finally, maintain communication records with all involved parties. Each step helps reinforce your case. It’s essential to stay focused and organized. Legal processes may seem daunting, but staying informed helps you reclaim control. Everyone deserves justice and the means to heal. You can navigate this challenge with careful preparation and support. This blog offers insights to help you through each stage of the process. You hold the key to your case’s success.

Gathering Evidence

Evidence is the backbone of your case. To prove liability, compile detailed information about the incident. Start with the police report. This document provides an official account of the event. Witness statements strengthen your case. They offer unbiased perspectives on what happened. Photos of the accident scene can capture crucial details. Visual evidence can clarify how events unfolded.

Medical Documentation

Your injuries are a critical part of the evidence. Medical records document the extent and impact of your injuries. They connect your injuries to the incident. Keep all medical bills and related expenses. This information supports claims for financial compensation.

Communication Records

Keep a detailed log of all communications. This includes interactions with insurance companies and other parties. Emails, letters, and phone call notes can reveal valuable information. They can show offers, admissions, or statements that affect responsibility.

Types of Liability

Understanding liability types helps you build a stronger case. Here are common types:

- Negligence: Failing to act with reasonable care.

- Strict Liability: Responsibility without proof of fault, common in product liability cases.

- Intentional Wrongdoing: Harm caused on purpose.

Comparative Negligence in Nevada

Nevada follows a comparative negligence rule. If you share some fault, it affects your compensation. For example, if you are 20% at fault, your damages reduce by 20%. Understanding this rule is vital for realistic expectations.

Comparison Table: Types of Liability

| Type | Description | Proof Required |

| Negligence | Lack of reasonable care | Prove negligence elements |

| Strict Liability | Liability without fault | Show defect and harm |

| Intentional Wrongdoing | Harm by deliberate action | Prove intent |

Legal Support and Resources

Pursuing a lawsuit is complex. Legal assistance can guide you. Experienced attorneys know the process well. They can help you build your case effectively. USA.gov offers resources for finding legal aid in Nevada.

Conclusion

Proving liability in a personal injury lawsuit requires diligence and determination. By gathering comprehensive evidence, documenting medical details, and understanding liability types, you can build a compelling case. Resources like LawHelp.org provide valuable information for those seeking legal guidance. Stay organized and informed throughout the process. With careful preparation and support, you can achieve the justice you deserve.

-

BLOG2 months ago

BLOG2 months agoIZoneMedia360 .Com: Exploring the Features and Benefits

-

BLOG5 months ago

BLOG5 months agoAbout Blog TurboGeekOrg: A Go-To Hub for Tech Enthusiasts and Latest Innovations

-

BLOG5 months ago

BLOG5 months agoWhat is a Golden Transit in Magi Astrology?

-

BLOG2 months ago

BLOG2 months agoA Complete Guide to ProcurementNation.com Shipping

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months agoTyquaez Pickett: A Rising Star in the Entertainment World

-

NEWS1 month ago

NEWS1 month agoChloe Berger News: Insights on Employee Rights and Talent Retention

-

HOME2 months ago

HOME2 months ago5StarsStocks.com Nickel: Invest for a Bright Future

-

BLOG4 months ago

BLOG4 months agoWho Is Hall Sinclair? The True Story of Olivia Colman’s Son